Price | 1W % | 1M % | 3M % | 6M % | 1Y % | YTD % |

|---|---|---|---|---|---|---|

-- | -- | -- | -- | -- | -- | -- |

AI Generated Qualitative Analysis

Your time is precious, so save it. Use AI to get the most important information from the business.

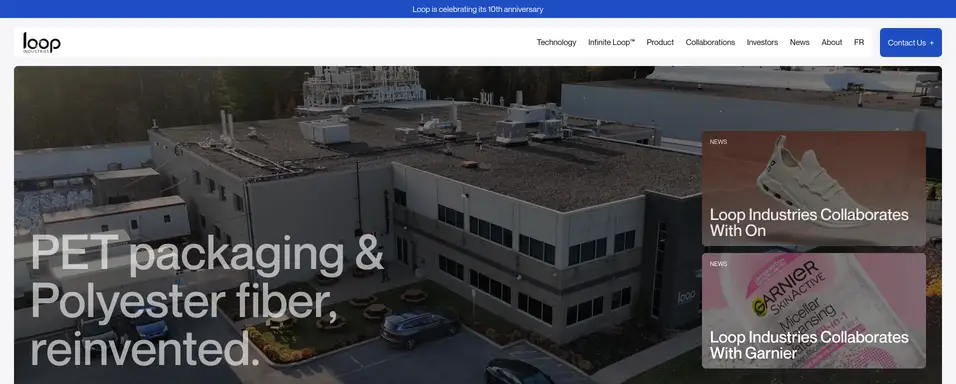

Learn about Loop Industries, Inc.

Loop Industries, Inc. News

Loop Industries, Inc. Quantitative Score

About Loop Industries, Inc.

Loop Industries, Inc., a technology company, focuses on depolymerizing waste polyethylene terephthalate (PET) plastics and polyester fibers into base building blocks. It polymerized monomers into virgin-quality PET resins for use in food-grade plastic packaging, such as plastic bottles for water and carbonated soft drinks, and containers for food and other consumer products; and polyester fibers, including textiles, clothing, and apparel. The company was incorporated in 2010 and is based in Terrebonne, Canada.

Loop Industries, Inc. Earnings & Revenue

What’s This Company Really Worth? Find Out Instantly.

Warren Buffett’s go-to valuation method is Discounted Cash Flow (DCF). Our tool makes it effortless — no spreadsheets, just answers in a few clicks.

Loop Industries, Inc. Financials

Table Compare

Compare LOOP metrics with: | |||

|---|---|---|---|

Earnings & Growth | LOOP | None | |

EPS (TTM) YoY Growth | -- | -- | |

Revenue (TTM) YoY Growth | -- | -- | |

Valuation (TTM) | LOOP | None | |

Price/Earnings Ratio | -- | -- | |

Price/Sales Ratio | -- | -- | |

Profitability & Efficiency (TTM) | LOOP | None | |

Net Profit Margin | -- | -- | |

Return on Equity | -- | -- | |

Financial Health (TTM) | LOOP | None | |

Debt/Assets Ratio | -- | -- | |

Assets/Liabilities Ratio | -- | -- | |

Loop Industries, Inc. Income

Loop Industries, Inc. Balance Sheet

Loop Industries, Inc. Cash Flow

Loop Industries, Inc. Financials Over Time

Analysts Rating

Strong Buy

Buy

Hold

Sell

Strong Sell

Metrics Scores

| Metrics | Score |

|---|---|

| Discounted Cash Flows | Neutral |

| Return on Equity | Strong Buy |

| Return on Assets | Strong Sell |

| Debt/Equity Ratio | Strong Sell |

| Price/Earnings Ratio | Strong Sell |

| Price/Book Ratio | Strong Sell |

Price Targets

Disclaimer: This 3rd party analysis information is for reference only and does not constitute investment advice.

Historical Market Cap

Shares Outstanding

Loop Industries, Inc. Executives

| Name | Role |

|---|---|

| Mr. Nicolas Lafond | Interim Chief Financial Officer, Senior Director of Finance & Corporate Secretary |

| Mr. Daniel Solomita | Founder, Chairman of the Board, Chief Executive Officer & President |

| Mr. Stephen Champagne | Chief Technology Officer |

| Mike De Notaris | Vice President of Corporate Development |

| Mr. Giovanni Catino | Chief Revenue Officer |

| Name | Role | Gender | Date of Birth | Pay |

|---|---|---|---|---|

| Mr. Nicolas Lafond | Interim Chief Financial Officer, Senior Director of Finance & Corporate Secretary | Male | 582.99K | |

| Mr. Daniel Solomita | Founder, Chairman of the Board, Chief Executive Officer & President | Male | 1976 | 566.59K |

| Mr. Stephen Champagne | Chief Technology Officer | Male | 1968 | 277.8K |

| Mike De Notaris | Vice President of Corporate Development | -- | ||

| Mr. Giovanni Catino | Chief Revenue Officer | Male | -- |

Loop Industries, Inc. Insider Trades

| Date | 24 Jul |

| Name | Hart Spencer |

| Role | Director |

| Transaction | Acquired |

| Type | P-Purchase |

| Shares | 41317 |

| Date | 25 Jul |

| Name | Hart Spencer |

| Role | Director |

| Transaction | Acquired |

| Type | P-Purchase |

| Shares | 27562 |

| Date | 28 Jul |

| Name | Hart Spencer |

| Role | Director |

| Transaction | Acquired |

| Type | P-Purchase |

| Shares | 29121 |

| Date | 23 Jul |

| Name | Solomita Daniel |

| Role | Chief Executive Officer |

| Transaction | Acquired |

| Type | P-Purchase |

| Shares | 906794 |

| Date | 23 Jul |

| Name | Sellyn Laurence G. |

| Role | Director |

| Transaction | Acquired |

| Type | P-Purchase |

| Shares | 150000 |

| Date | Name | Role | Transaction | Type | Shares |

|---|---|---|---|---|---|

| 24 Jul | Hart Spencer | Director | Acquired | P-Purchase | 41317 |

| 25 Jul | Hart Spencer | Director | Acquired | P-Purchase | 27562 |

| 28 Jul | Hart Spencer | Director | Acquired | P-Purchase | 29121 |

| 23 Jul | Solomita Daniel | Chief Executive Officer | Acquired | P-Purchase | 906794 |

| 23 Jul | Sellyn Laurence G. | Director | Acquired | P-Purchase | 150000 |