Price | 1W % | 1M % | 3M % | 6M % | 1Y % | YTD % |

|---|---|---|---|---|---|---|

-- | -- | -- | -- | -- | -- | -- |

AI Generated Qualitative Analysis

Your time is precious, so save it. Use AI to get the most important information from the business.

Learn about Host Hotels & Resorts, Inc.

Host Hotels & Resorts, Inc. News

Host Hotels & Resorts, Inc. Quantitative Score

About Host Hotels & Resorts, Inc.

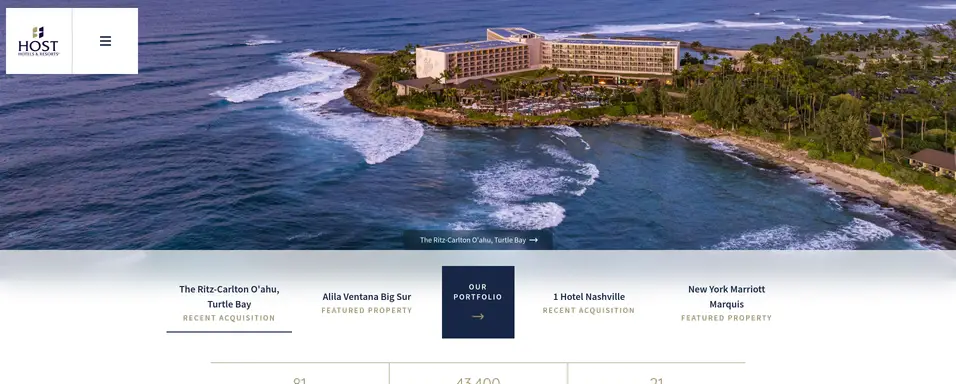

Host Hotels & Resorts, Inc. is an S&P 500 company and is the largest lodging real estate investment trust and one of the largest owners of luxury and upper-upscale hotels. The Company currently owns 74 properties in the United States and five properties internationally totaling approximately 46,100 rooms. The Company also holds non-controlling interests in six domestic and one international joint ventures. Guided by a disciplined approach to capital allocation and aggressive asset management, the Company partners with premium brands such as Marriott®, Ritz-Carlton®, Westin®, Sheraton®, W®, St. Regis®, The Luxury Collection®, Hyatt®, Fairmont®, Hilton®, Swissôtel®, ibis® and Novotel®, as well as independent brands. For additional information, please visit the Company's website at www.hosthotels.com.

Host Hotels & Resorts, Inc. Earnings & Revenue

What’s This Company Really Worth? Find Out Instantly.

Warren Buffett’s go-to valuation method is Discounted Cash Flow (DCF). Our tool makes it effortless — no spreadsheets, just answers in a few clicks.

Host Hotels & Resorts, Inc. Financials

Table Compare

Compare HST metrics with: | |||

|---|---|---|---|

Earnings & Growth | HST | None | |

EPS (TTM) YoY Growth | -- | -- | |

Revenue (TTM) YoY Growth | -- | -- | |

Valuation (TTM) | HST | None | |

Price/Earnings Ratio | -- | -- | |

Price/Sales Ratio | -- | -- | |

Profitability & Efficiency (TTM) | HST | None | |

Net Profit Margin | -- | -- | |

Return on Equity | -- | -- | |

Financial Health (TTM) | HST | None | |

Debt/Assets Ratio | -- | -- | |

Assets/Liabilities Ratio | -- | -- | |

Host Hotels & Resorts, Inc. Income

Host Hotels & Resorts, Inc. Balance Sheet

Host Hotels & Resorts, Inc. Cash Flow

Host Hotels & Resorts, Inc. Financials Over Time

Analysts Rating

Strong Buy

Buy

Hold

Sell

Strong Sell

Metrics Scores

| Metrics | Score |

|---|---|

| Discounted Cash Flows | Strong Sell |

| Return on Equity | Buy |

| Return on Assets | Strong Buy |

| Debt/Equity Ratio | Sell |

| Price/Earnings Ratio | Neutral |

| Price/Book Ratio | Sell |

Price Targets

Disclaimer: This 3rd party analysis information is for reference only and does not constitute investment advice.

Host Hotels & Resorts, Inc. Dividends

| Yield (TTM) | Dividend (TTM) | |

|---|---|---|

Infinity% | 0.9500 |

| Payment Date | Dividend | Frequency |

|---|---|---|

| 2026-01-15 | 0.35 | Quarterly |

| 2025-10-15 | 0.2 | Quarterly |

| 2025-07-15 | 0.2 | Quarterly |

| 2025-04-15 | 0.2 | Quarterly |

| 2025-01-15 | 0.3 | Quarterly |

Historical Market Cap

Shares Outstanding

Host Hotels & Resorts, Inc. Executives

| Name | Role |

|---|---|

| James F. Risoleo | President, Chief Executive Officer & Director |

| Sourav Ghosh | Executive VP & CFO |

| Nathan S. Tyrrell | Executive VP & Chief Investment Officer |

| Julie Aslaksen | Executive VP, General Counsel & Secretary |

| Michael E. Lentz | Executive Vice President of Development, Design & Construction |

| Name | Role | Gender | Date of Birth | Pay |

|---|---|---|---|---|

| James F. Risoleo | President, Chief Executive Officer & Director | Male | 1956 | 5.01M |

| Sourav Ghosh | Executive VP & CFO | Male | 1977 | 2.06M |

| Nathan S. Tyrrell | Executive VP & Chief Investment Officer | Male | 1973 | 1.91M |

| Julie Aslaksen | Executive VP, General Counsel & Secretary | Female | 1975 | 1.64M |

| Michael E. Lentz | Executive Vice President of Development, Design & Construction | Male | 1964 | 1.63M |

Host Hotels & Resorts, Inc. Insider Trades

| Date | 15 Jan |

| Name | Stein A William |

| Role | Director |

| Transaction | Acquired |

| Type | A-Award |

| Shares | 1789.865 |

| Date | 15 Jan |

| Name | Smith Gordon H |

| Role | Director |

| Transaction | Acquired |

| Type | A-Award |

| Shares | 3012.5099 |

| Date | 15 Jan |

| Name | Preusse Mary Hogan |

| Role | Director |

| Transaction | Acquired |

| Type | A-Award |

| Shares | 1812.5496 |

| Date | 15 Jan |

| Name | LAING DIANA |

| Role | Director |

| Transaction | Acquired |

| Type | A-Award |

| Shares | 749.0198 |

| Date | 15 Jan |

| Name | BAGLIVO MARY |

| Role | Director |

| Transaction | Acquired |

| Type | A-Award |

| Shares | 1612.5293 |

| Date | Name | Role | Transaction | Type | Shares |

|---|---|---|---|---|---|

| 15 Jan | Stein A William | Director | Acquired | A-Award | 1789.865 |

| 15 Jan | Smith Gordon H | Director | Acquired | A-Award | 3012.5099 |

| 15 Jan | Preusse Mary Hogan | Director | Acquired | A-Award | 1812.5496 |

| 15 Jan | LAING DIANA | Director | Acquired | A-Award | 749.0198 |

| 15 Jan | BAGLIVO MARY | Director | Acquired | A-Award | 1612.5293 |