Price | 1W % | 1M % | 3M % | 6M % | 1Y % | YTD % |

|---|---|---|---|---|---|---|

-- | -- | -- | -- | -- | -- | -- |

AI Generated Qualitative Analysis

Your time is precious, so save it. Use AI to get the most important information from the business.

Learn about Investcorp Credit Management BDC, Inc.

Investcorp Credit Management BDC, Inc. News

Investcorp Credit Management BDC, Inc. Quantitative Score

About Investcorp Credit Management BDC, Inc.

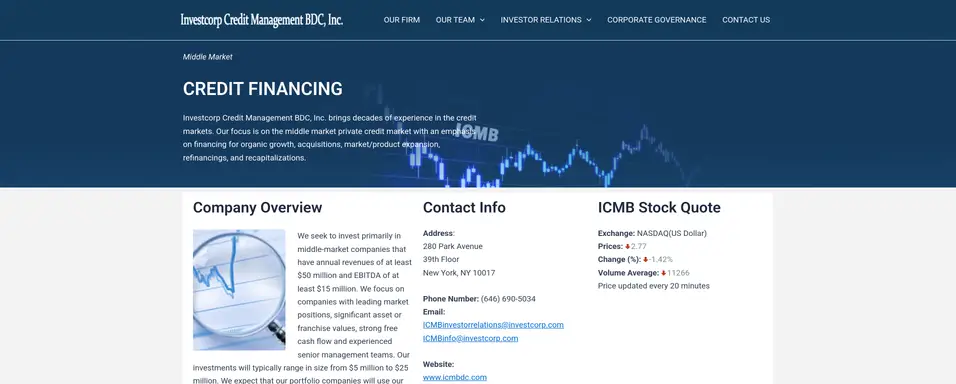

Investcorp Credit Management BDC, Inc. is a business development company specializing in loan, mezzanine, middle market, growth capital, acquisitions, market/product expansion, organic growth, refinancings and recapitalization investments. It also selectively invests in mezzanine loans/structured equity and in the equity of portfolio companies through warrants and other instruments, in most cases taking such upside participation interests as part of a broader investment relationship. The fund typically invests in United States and Europe. Within United States, the fund seeks to invest in Midatlantic, Midwest, Northeast, Southeast, and West Coast regions. The fund primarily invests in cable and satellites; consumer services; healthcare equipment and services; industrials; information technology; telecommunication services; and utilities sectors. The fund seeks to invest between $5 million to $25 million in companies that have annual revenues of at least $50 million with EBITDA at least $15 million.

Investcorp Credit Management BDC, Inc. Earnings & Revenue

What’s This Company Really Worth? Find Out Instantly.

Warren Buffett’s go-to valuation method is Discounted Cash Flow (DCF). Our tool makes it effortless — no spreadsheets, just answers in a few clicks.

Investcorp Credit Management BDC, Inc. Financials

Table Compare

Compare ICMB metrics with: | |||

|---|---|---|---|

Earnings & Growth | ICMB | None | |

EPS (TTM) YoY Growth | -- | -- | |

Revenue (TTM) YoY Growth | -- | -- | |

Valuation (TTM) | ICMB | None | |

Price/Earnings Ratio | -- | -- | |

Price/Sales Ratio | -- | -- | |

Profitability & Efficiency (TTM) | ICMB | None | |

Net Profit Margin | -- | -- | |

Return on Equity | -- | -- | |

Financial Health (TTM) | ICMB | None | |

Debt/Assets Ratio | -- | -- | |

Assets/Liabilities Ratio | -- | -- | |

Investcorp Credit Management BDC, Inc. Income

Investcorp Credit Management BDC, Inc. Balance Sheet

Investcorp Credit Management BDC, Inc. Cash Flow

Investcorp Credit Management BDC, Inc. Financials Over Time

Analysts Rating

Strong Buy

Buy

Hold

Sell

Strong Sell

Metrics Scores

| Metrics | Score |

|---|---|

| Discounted Cash Flows | Strong Buy |

| Return on Equity | Sell |

| Return on Assets | Neutral |

| Debt/Equity Ratio | Strong Sell |

| Price/Earnings Ratio | Strong Sell |

| Price/Book Ratio | Buy |

Price Targets

Disclaimer: This 3rd party analysis information is for reference only and does not constitute investment advice.

Investcorp Credit Management BDC, Inc. Dividends

| Yield (TTM) | Dividend (TTM) | |

|---|---|---|

Infinity% | 0.5200 |

| Payment Date | Dividend | Frequency |

|---|---|---|

| 2025-12-12 | 0.14 | Quarterly |

| 2025-10-09 | 0.14 | Quarterly |

| 2025-06-14 | 0.12 | Quarterly |

| 2025-05-16 | 0.12 | Quarterly |

| 2025-01-08 | 0.12 | Quarterly |

Historical Market Cap

Shares Outstanding

Investcorp Credit Management BDC, Inc. Executives

| Name | Role |

|---|---|

| Andrew Muns | COO, CFO, Treasurer & Secretary |

| Branko Krmpotic | Managing Director |

| Michael C. Mauer | Chairman of the Board & Vice Chairman of Private Credit |

| Paolo S. Cloma | C.C.O |

| Suhail Shaikh | Chief Executive Officer, Chief Information Officer of Private Credit & Director |

| Name | Role | Gender | Date of Birth | Pay |

|---|---|---|---|---|

| Andrew Muns | COO, CFO, Treasurer & Secretary | Male | 1973 | -- |

| Branko Krmpotic | Managing Director | Male | -- | |

| Michael C. Mauer | Chairman of the Board & Vice Chairman of Private Credit | Male | 1961 | -- |

| Paolo S. Cloma | C.C.O | Male | -- | |

| Suhail Shaikh | Chief Executive Officer, Chief Information Officer of Private Credit & Director | Male | 1968 | -- |

Investcorp Credit Management BDC, Inc. Insider Trades

| Date | 24 Mar |

| Name | Muns Robert Andrew |

| Role | Chief Operating Officer |

| Transaction | Disposed |

| Type | |

| Shares | 0 |

| Date | 16 Dec |

| Name | Shaikh Suhail A. |

| Role | President & CEO |

| Transaction | Acquired |

| Type | P-Purchase |

| Shares | 2500 |

| Date | 10 Dec |

| Name | Shaikh Suhail A. |

| Role | President & CEO |

| Transaction | Acquired |

| Type | P-Purchase |

| Shares | 4500 |

| Date | 1 Jul |

| Name | Tsin Walter |

| Role | Chief Financial Officer |

| Transaction | Disposed |

| Type | |

| Shares | 0 |

| Date | 2 Feb |

| Name | Shaikh Suhail A. |

| Role | President |

| Transaction | Disposed |

| Type | |

| Shares | 0 |

| Date | Name | Role | Transaction | Type | Shares |

|---|---|---|---|---|---|

| 24 Mar | Muns Robert Andrew | Chief Operating Officer | Disposed | 0 | |

| 16 Dec | Shaikh Suhail A. | President & CEO | Acquired | P-Purchase | 2500 |

| 10 Dec | Shaikh Suhail A. | President & CEO | Acquired | P-Purchase | 4500 |

| 1 Jul | Tsin Walter | Chief Financial Officer | Disposed | 0 | |

| 2 Feb | Shaikh Suhail A. | President | Disposed | 0 |