Price | 1W % | 1M % | 3M % | 6M % | 1Y % | YTD % |

|---|---|---|---|---|---|---|

-- | -- | -- | -- | -- | -- | -- |

iShares Russell 2000 ETF News

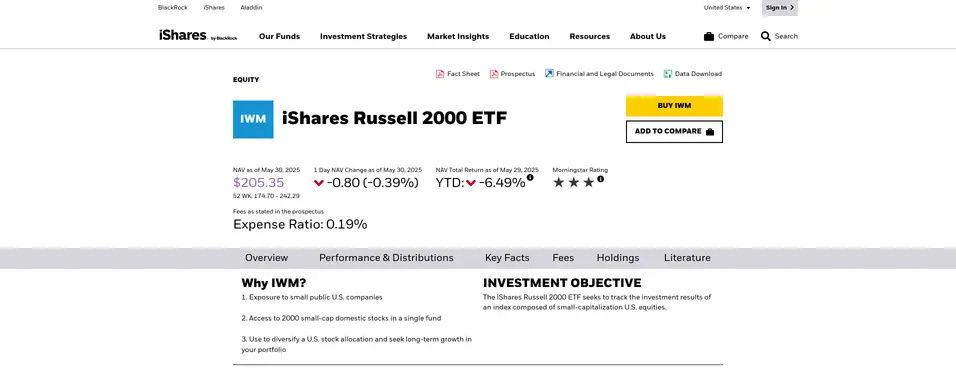

About iShares Russell 2000 ETF

The fund generally invests at least 80% of its assets in the component securities of its underlying index and in investments that have economic characteristics that are substantially identical to the component securities of its underlying index (i.e., depositary receipts representing securities of the underlying index) and may invest up to 20% of its assets in certain futures, options and swap contracts, cash and cash equivalents.

iShares Russell 2000 ETF Financials

Table Compare

Compare IWM metrics with: | |||

|---|---|---|---|

Earnings & Growth | IWM | None | |

EPS (TTM) YoY Growth | -- | -- | |

Revenue (TTM) YoY Growth | -- | -- | |

Valuation (TTM) | IWM | None | |

Price/Earnings Ratio | -- | -- | |

Price/Sales Ratio | -- | -- | |

Profitability & Efficiency (TTM) | IWM | None | |

Net Profit Margin | -- | -- | |

Return on Equity | -- | -- | |

Financial Health (TTM) | IWM | None | |

Debt/Assets Ratio | -- | -- | |

Assets/Liabilities Ratio | -- | -- | |

iShares Russell 2000 ETF Holdings

iShares Russell 2000 ETF Sector Weightings

iShares Russell 2000 ETF Country Weightings

iShares Russell 2000 ETF Financials Over Time

iShares Russell 2000 ETF Dividends

| Yield (TTM) | Dividend (TTM) | |

|---|---|---|

Infinity% | 2.5547 |

| Payment Date | Dividend | Frequency |

|---|---|---|

| 2025-12-19 | 0.84245 | Quarterly |

| 2025-09-19 | 0.6768 | Quarterly |

| 2025-06-20 | 0.57563 | Quarterly |

| 2025-03-21 | 0.45985 | Quarterly |

| 2024-12-20 | 0.694 | Quarterly |