Price | 1W % | 1M % | 3M % | 6M % | 1Y % | YTD % |

|---|---|---|---|---|---|---|

-- | -- | -- | -- | -- | -- | -- |

AI Generated Qualitative Analysis

Your time is precious, so save it. Use AI to get the most important information from the business.

Learn about Public Service Enterprise Group Incorporated

Public Service Enterprise Group Incorporated News

Public Service Enterprise Group Incorporated Quantitative Score

About Public Service Enterprise Group Incorporated

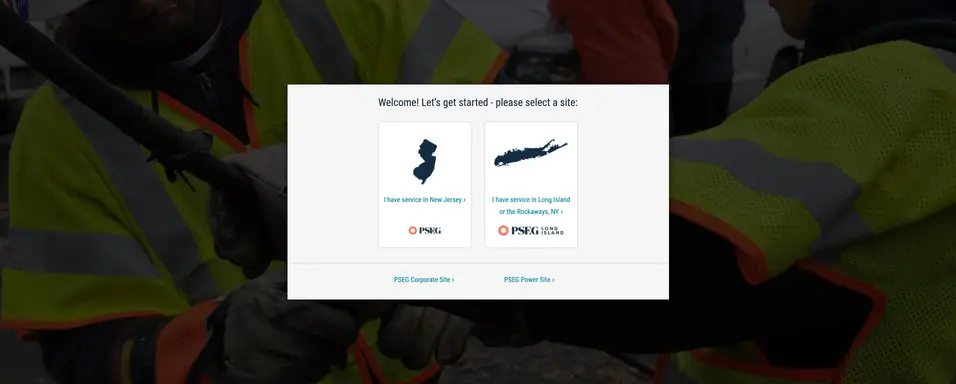

Public Service Enterprise Group Incorporated, through its subsidiaries, operates as an energy company primarily in the Northeastern and Mid-Atlantic United States. It operates through two segments, PSE&G and PSEG Power. The PSE&G segment transmits electricity; distributes electricity and gas to residential, commercial, and industrial customers, as well as invests in solar generation projects, and energy efficiency and related programs; and offers appliance services and repairs. As of December 31, 2021, it had electric transmission and distribution system of 25,000 circuit miles and 862,000 poles; 56 switching stations with an installed capacity of 39,353 megavolt-amperes (MVA), and 235 substations with an installed capacity of 9,285 MVA; four electric distribution headquarters and five electric sub-headquarters; and 18,000 miles of gas mains, 12 gas distribution headquarters, two sub-headquarters, and one meter shop, as well as 58 natural gas metering and regulating stations. Public Service Enterprise Group Incorporated was incorporated in 1985 and is based in Newark, New Jersey.

Public Service Enterprise Group Incorporated Earnings & Revenue

What’s This Company Really Worth? Find Out Instantly.

Warren Buffett’s go-to valuation method is Discounted Cash Flow (DCF). Our tool makes it effortless — no spreadsheets, just answers in a few clicks.

Public Service Enterprise Group Incorporated Financials

Table Compare

Compare PEG metrics with: | |||

|---|---|---|---|

Earnings & Growth | PEG | None | |

EPS (TTM) YoY Growth | -- | -- | |

Revenue (TTM) YoY Growth | -- | -- | |

Valuation (TTM) | PEG | None | |

Price/Earnings Ratio | -- | -- | |

Price/Sales Ratio | -- | -- | |

Profitability & Efficiency (TTM) | PEG | None | |

Net Profit Margin | -- | -- | |

Return on Equity | -- | -- | |

Financial Health (TTM) | PEG | None | |

Debt/Assets Ratio | -- | -- | |

Assets/Liabilities Ratio | -- | -- | |

Public Service Enterprise Group Incorporated Income

Public Service Enterprise Group Incorporated Balance Sheet

Public Service Enterprise Group Incorporated Cash Flow

Public Service Enterprise Group Incorporated Financials Over Time

Analysts Rating

Strong Buy

Buy

Hold

Sell

Strong Sell

Metrics Scores

| Metrics | Score |

|---|---|

| Discounted Cash Flows | Strong Sell |

| Return on Equity | Buy |

| Return on Assets | Buy |

| Debt/Equity Ratio | Sell |

| Price/Earnings Ratio | Sell |

| Price/Book Ratio | Sell |

Price Targets

Disclaimer: This 3rd party analysis information is for reference only and does not constitute investment advice.

Public Service Enterprise Group Incorporated Dividends

| Yield (TTM) | Dividend (TTM) | |

|---|---|---|

Infinity% | 2.5600 |

| Payment Date | Dividend | Frequency |

|---|---|---|

| 2026-03-31 | 0.67 | Quarterly |

| 2025-12-31 | 0.63 | Quarterly |

| 2025-09-30 | 0.63 | Quarterly |

| 2025-06-30 | 0.63 | Quarterly |

| 2025-03-31 | 0.63 | Quarterly |

Historical Market Cap

Shares Outstanding

Public Service Enterprise Group Incorporated Executives

| Name | Role |

|---|---|

| Ralph A. LaRossa | Chair, President & Chief Executive Officer |

| Daniel J. Cregg | Executive Vice President & Chief Financial Officer |

| Kim C. Hanemann | President & COO of Public Service Electric & Gas |

| Richard T. Thigpen | Senior Vice President of Corporate Citizenship |

| Scott Jennings | Senior Vice President of Finance, Planning & Strategy |

| Name | Role | Gender | Date of Birth | Pay |

|---|---|---|---|---|

| Ralph A. LaRossa | Chair, President & Chief Executive Officer | Male | 1963 | 3.87M |

| Daniel J. Cregg | Executive Vice President & Chief Financial Officer | Male | 1964 | 1.88M |

| Kim C. Hanemann | President & COO of Public Service Electric & Gas | Female | 1964 | 1.68M |

| Richard T. Thigpen | Senior Vice President of Corporate Citizenship | Male | 1961 | -- |

| Scott Jennings | Senior Vice President of Finance, Planning & Strategy | Male | -- |

Public Service Enterprise Group Incorporated Insider Trades

| Date | 24 Feb |

| Name | Thigpen Richard T |

| Role | SVP Corporate Citizenship |

| Transaction | Acquired |

| Type | A-Award |

| Shares | 10192.548 |

| Date | 24 Feb |

| Name | Thigpen Richard T |

| Role | SVP Corporate Citizenship |

| Transaction | Acquired |

| Type | A-Award |

| Shares | 2088 |

| Date | 24 Feb |

| Name | Thigpen Richard T |

| Role | SVP Corporate Citizenship |

| Transaction | Disposed |

| Type | F-InKind |

| Shares | 4058 |

| Date | 24 Feb |

| Name | Rostiac Sheila J |

| Role | SVP CAO & CHRO |

| Transaction | Acquired |

| Type | A-Award |

| Shares | 12972.823 |

| Date | 24 Feb |

| Name | Rostiac Sheila J |

| Role | SVP CAO & CHRO |

| Transaction | Acquired |

| Type | A-Award |

| Shares | 3827 |

| Date | Name | Role | Transaction | Type | Shares |

|---|---|---|---|---|---|

| 24 Feb | Thigpen Richard T | SVP Corporate Citizenship | Acquired | A-Award | 10192.548 |

| 24 Feb | Thigpen Richard T | SVP Corporate Citizenship | Acquired | A-Award | 2088 |

| 24 Feb | Thigpen Richard T | SVP Corporate Citizenship | Disposed | F-InKind | 4058 |

| 24 Feb | Rostiac Sheila J | SVP CAO & CHRO | Acquired | A-Award | 12972.823 |

| 24 Feb | Rostiac Sheila J | SVP CAO & CHRO | Acquired | A-Award | 3827 |