Price | 1W % | 1M % | 3M % | 6M % | 1Y % | YTD % |

|---|---|---|---|---|---|---|

-- | -- | -- | -- | -- | -- | -- |

ProShares Ultra Real Estate News

About ProShares Ultra Real Estate

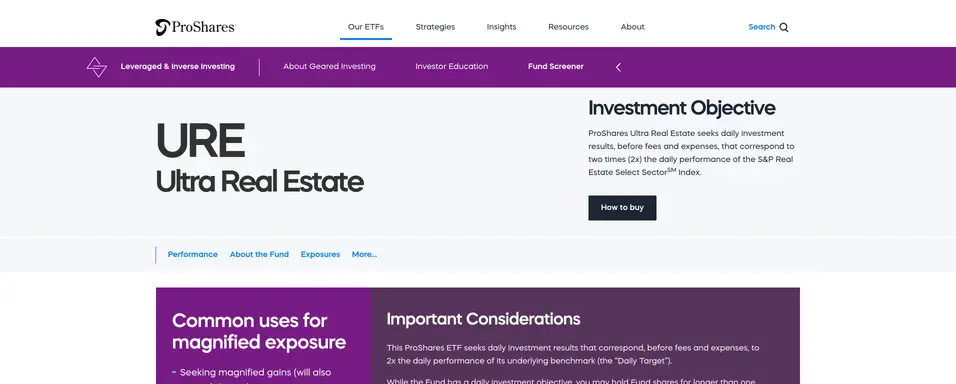

The fund invests in financial instruments that the advisors believe, in combination, should produce daily returns consistent with the fund's investment objective. The index is designed to track the performance of REITs and other companies that invest directly or indirectly in real estate through development, management, or ownership, including property agencies. Component companies include, among others, real estate holding and development and real estate services companies and REITs. The fund is non-diversified.

ProShares Ultra Real Estate Financials

Table Compare

Compare URE metrics with: | |||

|---|---|---|---|

Earnings & Growth | URE | None | |

EPS (TTM) YoY Growth | -- | -- | |

Revenue (TTM) YoY Growth | -- | -- | |

Valuation (TTM) | URE | None | |

Price/Earnings Ratio | -- | -- | |

Price/Sales Ratio | -- | -- | |

Profitability & Efficiency (TTM) | URE | None | |

Net Profit Margin | -- | -- | |

Return on Equity | -- | -- | |

Financial Health (TTM) | URE | None | |

Debt/Assets Ratio | -- | -- | |

Assets/Liabilities Ratio | -- | -- | |

ProShares Ultra Real Estate Holdings

ProShares Ultra Real Estate Sector Weightings

ProShares Ultra Real Estate Country Weightings

ProShares Ultra Real Estate Financials Over Time

ProShares Ultra Real Estate Dividends

| Yield (TTM) | Dividend (TTM) | |

|---|---|---|

Infinity% | 1.3303 |

| Payment Date | Dividend | Frequency |

|---|---|---|

| 2025-09-30 | 0.36122 | Quarterly |

| 2025-07-01 | 0.29233 | Quarterly |

| 2025-04-01 | 0.25555 | Quarterly |

| 2024-12-31 | 0.42124 | Quarterly |

| 2024-10-02 | 0.31505 | Quarterly |